Beneficiary ira calculator

Beneficiary IRA Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the. For comparison purposes Roth IRA.

New Rules For Inherited Iras What Is The New 10 Year Rule Marca

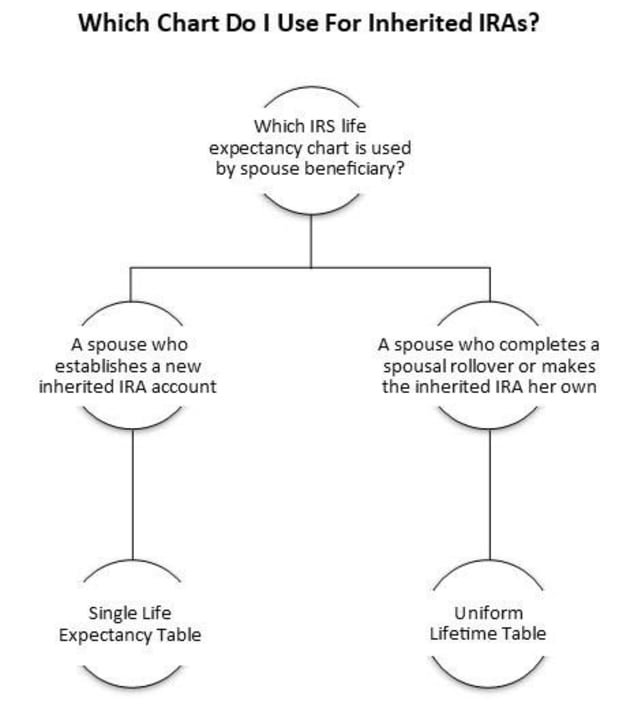

Yes Spouses date of birth Your Required Minimum.

. With our IRA calculators you can determine potential tax. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you.

If you were born. Beneficiarys birthdate Enter the beneficiarys birth date. Your ability to access these options depends on whether the original owner of the IRA was under or at least age 72.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. You can also explore your IRA beneficiary withdrawal options based. Beneficiary IRA Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the.

Find a Dedicated Financial Advisor Now. Beneficiary Date of Birth mmddyyyy. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Determine beneficiarys age at year-end following year of owners. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Hypothetical Interest rate This is the expected rate of return on your account.

Years Until Retirement Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. Distribute using Table I. This calculator is undergoing maintenance for the new IRS tables.

Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. We offer bulk pricing on orders over 10 calculators. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. The SECURE Act of 2019 changed the age that RMDs must begin. IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the.

For assistance please contact 800-435-4000. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

401 k and IRA Required Minimum Distribution Calculator Determine your Required Minimum Distribution RMD from a traditional 401 k or IRA. Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary. Get your own custom-built calculator.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Search For Info About Your Query.

IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. This is used for calculating life expectancy. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade.

Browse Get Results Instantly. 401 k Save the Max Calculator. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. As a beneficiary you may be required by the IRS to take. If you are age 72 you may be subject to taking annual withdrawals known as.

The first option allows most of your funds to grow for. Do Your Investments Align with Your Goals. If inherited assets have been transferred.

If inherited assets have been transferred into an inherited IRA in your name. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Irs Wants To Change The Inherited Ira Distribution Rules

Pin On Report Template

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Required Minimum Distribution Calculator

Required Minimum Distributions For Retirement Morgan Stanley

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Inherited Ira Rmd Calculator Td Ameritrade

The Top 5 Ira Reminders For Year End 2022

Inherited Iras What Beneficiaries Need To Know Rosenberg Chesnov

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

How To Calculate Rmds Forbes Advisor

Inheriting An Ira H R Block

Can An Inherited Ira Be Rolled Over Smartasset

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner